TrustJabber.com — Consumer Protection Voice

1. Introduction: What IDSGroupLimited.com Claims

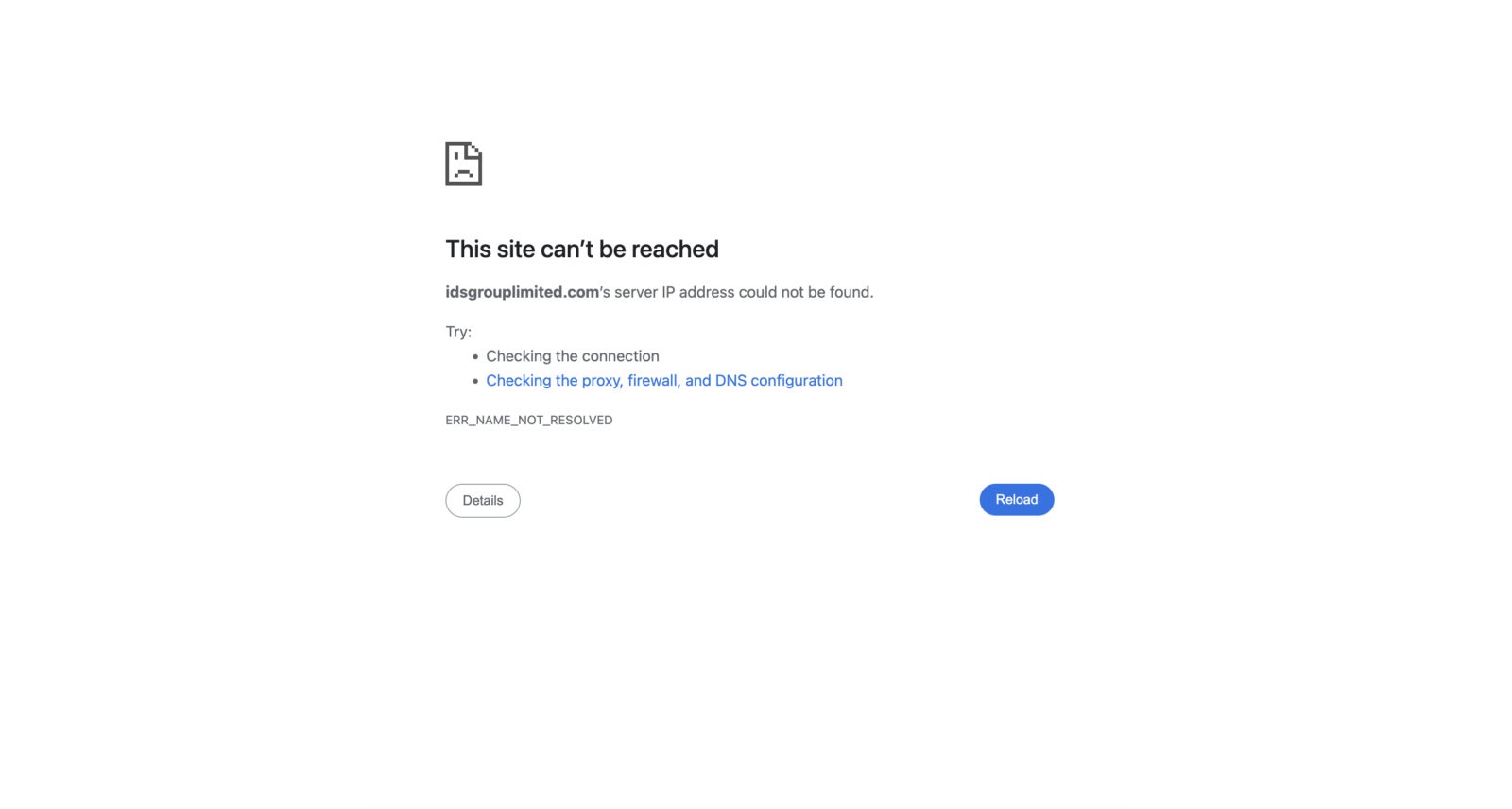

IDSGroupLimited.com presents itself as a corporate financial services platform offering investment opportunities and access to online trading. The website is polished and communicates confidence in its services, with a focus on convenience and potential returns.

For someone exploring financial platforms online, a professional design and clear messaging can feel reassuring. However, it’s important to look beyond appearances and understand IDSGroupLimited.com structure, regulatory status, and user experiences before making financial decisions.

2. Understanding the Platform

IDSGroupLimited.com positions itself as a modern solution for investors. It promises accessibility, streamlined account management, and potential growth opportunities. While these claims are appealing, consumers need to consider several critical questions:

-

Who runs the platform, and are ownership details publicly available?

-

Is the company regulated by recognized financial authorities?

-

How secure are deposits and withdrawals?

-

What do actual users report about their experiences?

Approaching these questions with care can help avoid potential risks.

3. Corporate Transparency

Transparency is a key measure of trustworthiness in financial services. Platforms that clearly communicate ownership, leadership, and operational headquarters give users a baseline for accountability.

With IDSGroupLimited.com, information about corporate ownership and executive leadership is limited. While this does not immediately indicate wrongdoing, it does mean users have less clarity about who is responsible for platform operations and customer support.

Think of it as entering a business agreement: knowing your counterpart reduces uncertainty and risk.

4. Regulatory Status

Regulation is an important factor in evaluating financial platforms. A platform overseen by recognized financial authorities must comply with rules, provide safeguards for customer funds, and offer recourse in case of disputes.

IDSGroupLimited.com does not display verifiable licensing information from major financial regulators. Lack of confirmed regulatory oversight increases the potential risk for consumers, as there is no official body monitoring the company’s operations or protecting user funds.

5. User Experience Insights

Examining consumer experiences can reveal practical issues users face on the platform. Reported experiences with IDSGroupLimited.com include:

-

Slow or delayed withdrawal processing

-

Limited or delayed support responses

-

Occasional confusion regarding account or service terms

While not all users encounter problems, these reports suggest the platform’s operations may not always be seamless, and careful monitoring is recommended.

6. Risk Assessment

Several points stand out in evaluating IDSGroupLimited.com:

-

Limited corporate transparency: Ownership and leadership are not fully disclosed

-

Unverified regulatory oversight: No confirmed financial licensing

-

Mixed user reports: Some indicate operational challenges

-

Marketing emphasis: Focus on potential returns without detailed discussion of risks

Each of these factors contributes to a higher risk profile for consumers considering using the platform.

7. TrustJabber Safety Score

TrustJabber Safety Score: 24 / 100

This score reflects:

-

Absence of verified regulatory oversight

-

Limited transparency in operations and ownership

-

Consumer experiences indicating procedural challenges

A score in this range signals that the platform carries a higher potential risk, and consumers should approach cautiously.

8. Are Your Funds Safe?

Due to the lack of verified regulatory oversight and limited transparency, funds deposited on IDSGroupLimited.com cannot be considered fully secure.

Consumers should always be vigilant when using platforms without clear regulatory safeguards. Maintaining records of all transactions and monitoring accounts closely is essential.

9. Recommendations for Current Users

If you have an active account or have deposited funds:

-

Avoid making additional deposits until you are confident in the platform

-

Keep comprehensive records of all transactions and communications

-

Regularly monitor account activity and withdrawal processes

-

Consider professional assistance for tracing or recovering funds, such as lostfundsrecovery.com, if issues arise

Early action and detailed documentation can help mitigate potential risks.

10. A Practical Guide to Safer Investing

Even when platforms appear professional, users should adopt a careful, analytical approach:

-

Verify the platform’s regulatory compliance

-

Research ownership and operational transparency

-

Review multiple user experiences for consistent patterns

-

Remember that marketing claims of high returns are never guarantees

Taking a structured, informed approach is the most reliable way to protect your money.

11. Final Thoughts

IDSGroupLimited.com may offer investment opportunities and financial tools, but uncertainties remain. Limited transparency, unverified regulation, and mixed consumer experiences suggest a cautious approach is warranted.

Users should proceed carefully, maintain records of all interactions, and consider professional guidance for any issues.

TrustJabber Safety Score (2025): 24 / 100

This platform should be evaluated carefully before committing any funds.

Internal Links & Resources

For additional guidance, consider these linked resources on your platform:

-

Protect yourself with our [Online Scam Safety Guide.]

-

Learn to assess platforms using [How to Verify Trading Platforms]

-

Spot fraud with [Most Common Online Scam Tactics.]

-

Steps to take with suspicious sites in [What to Do After Being Scammed]

-

Learn red flags in [Warning Signs of Fake Investment Websites]

-

Keep your digital assets safe with [Crypto Fraud Safety Guide]

Leave a comment