Online trading and wealth management platforms have grown rapidly, offering access to stocks, crypto, and alternative assets from anywhere in the world. But not every platform is what it appears to be. Crestview-Wealth-Partners.com, operated under the name Crestview Wealth Partners Ltd, has recently attracted attention for being potentially unsafe for investors.

This review examines why Crestview Wealth Partners raises concerns, including its claims, operational inconsistencies, and signs of high-risk behavior.

What Crestview-Wealth-Partners.com Presents to Investors

Crestview Wealth Partners portrays itself as an international investment company founded in Switzerland in 2017. Its website promises high returns across multiple asset classes—cryptocurrencies, equities, and real estate—while highlighting a global client network and supposedly large insurance coverage. Users are offered access to investment accounts, trading tools, and referral programs that encourage network growth.

While these claims sound appealing, closer inspection uncovers multiple red flags that challenge the platform’s credibility.

Key Indicators of Risk

1. Lack of Regulatory Oversight

Despite its promises, Crestview Wealth Partners Ltd is not licensed by major financial authorities like the UK’s FCA or the US SEC. Regulatory supervision is essential for investor protection, transparency, and accountability. Without it, clients have virtually no legal recourse if funds are mismanaged or withheld.

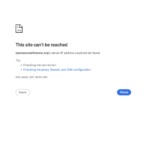

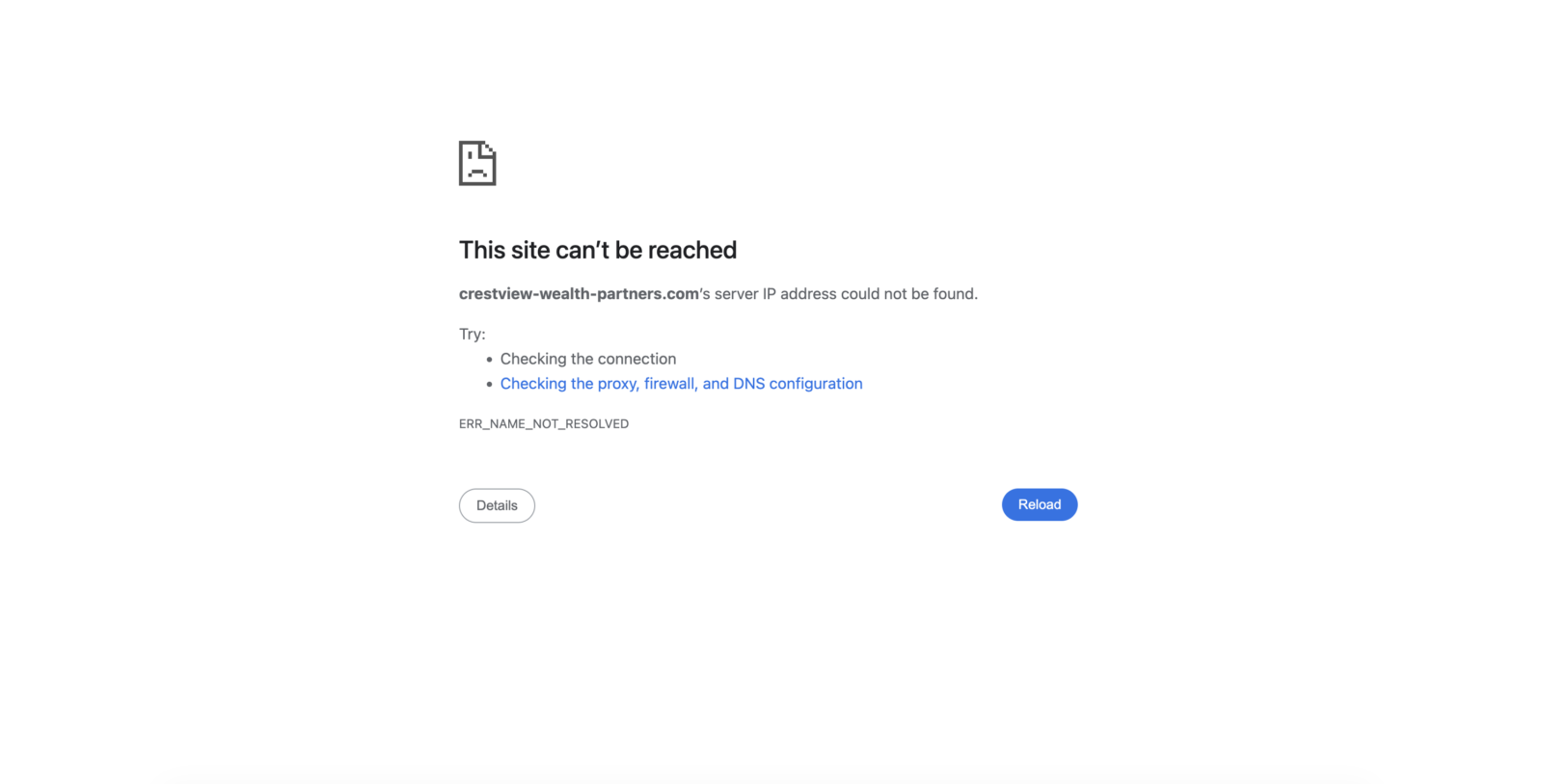

2. New Domain and Limited Online Presence

The platform’s domain, crestview-wealth-partners.com, is relatively new and has low visibility in trustworthy third-party sources. Security measures like SSL encryption may give a sense of safety, but these do not confirm legitimacy. Analysts note that isolated hosting, low online reputation, and connections to other high-risk domains are common markers of potentially fraudulent websites.

3. Unrealistic Profit Promises

The website advertises extraordinarily high returns, sometimes claiming daily gains of 5–17.5%. It also references massive insurance coverage of hundreds of millions, but such claims are unverifiable. Promises of consistent high profits are a hallmark of high-risk schemes, particularly when paired with referral incentives.

4. Opaque Ownership and Management

There is very little information on who runs Crestview Wealth Partners. No verifiable company registration, no management details, and no physical office addresses are provided. Lack of transparency makes it nearly impossible to hold the platform accountable.

5. Deceptive Website Practices

The website features generic testimonials, unclear investment explanations, and poorly written content. Payment methods are often anonymous or hard to trace, including cryptocurrency deposits. Minimum investment thresholds are high, pressuring clients to commit large sums without adequate information.

How High-Risk Platforms Operate

Scam brokers and high-risk investment sites often use psychological tactics to attract and retain deposits:

-

Controlled account dashboards that simulate growth

-

Early small withdrawals to build trust, then restrictions on larger sums

-

Pressure to deposit additional funds to unlock supposed profits

-

Aggressive marketing messages or celebrity endorsements that may be fabricated

These tactics create an illusion of legitimacy while maintaining control over client funds.

If You Have Been Affected

Investors who suspect they’ve been misled by Crestview-Wealth-Partners.com should act quickly:

-

Stop all contact with the platform to prevent further losses.

-

Document everything, including transaction receipts, emails, and screenshots.

-

Report the scam to authorities and online monitoring platforms.

Trustjabber recommends using LostFundsRecovery.com, a recovery service specializing in helping victims of online broker and crypto scams. Their services include:

-

Investigating fraudulent platforms and transactions

-

Assisting with chargebacks for card payments

-

Tracing cryptocurrency transactions through blockchain analysis

-

Providing legal guidance and filing complaints with authorities

-

Educating victims on scam prevention and safe investing

While recovery cannot be guaranteed, professional assistance significantly increases the chances of retrieving lost funds.

Bottom Line

Crestview-Wealth-Partners.com exhibits multiple characteristics of a high-risk or potentially fraudulent platform:

-

Unverified claims of regulation and corporate legitimacy

-

Opaque ownership and management

-

Unrealistic return promises and referral incentives

-

Withdrawal obstacles and unresponsive support

Investors’ funds are at substantial risk. Anyone considering this platform should proceed with extreme caution or avoid it entirely. Always verify regulatory credentials, seek independent reviews, and prioritize transparency before investing.

Protect Yourself and Your Funds

If you’ve lost money through Crestview-Wealth-Partners.com, recovery efforts should begin promptly. LostFundsRecovery.com offers specialized assistance to help victims reclaim assets from high-risk and fraudulent brokers.

For scam alerts, broker reviews, and investor safety guidance, continue following Trustjabber.

Internal Links & Resources

For additional guidance, consider these linked resources on your platform:

-

Protect yourself with our [Online Scam Safety Guide.]

-

Learn to assess platforms using [How to Verify Trading Platforms]

-

Spot fraud with [Most Common Online Scam Tactics.]

-

Steps to take with suspicious sites in [What to Do After Being Scammed]

Leave a comment