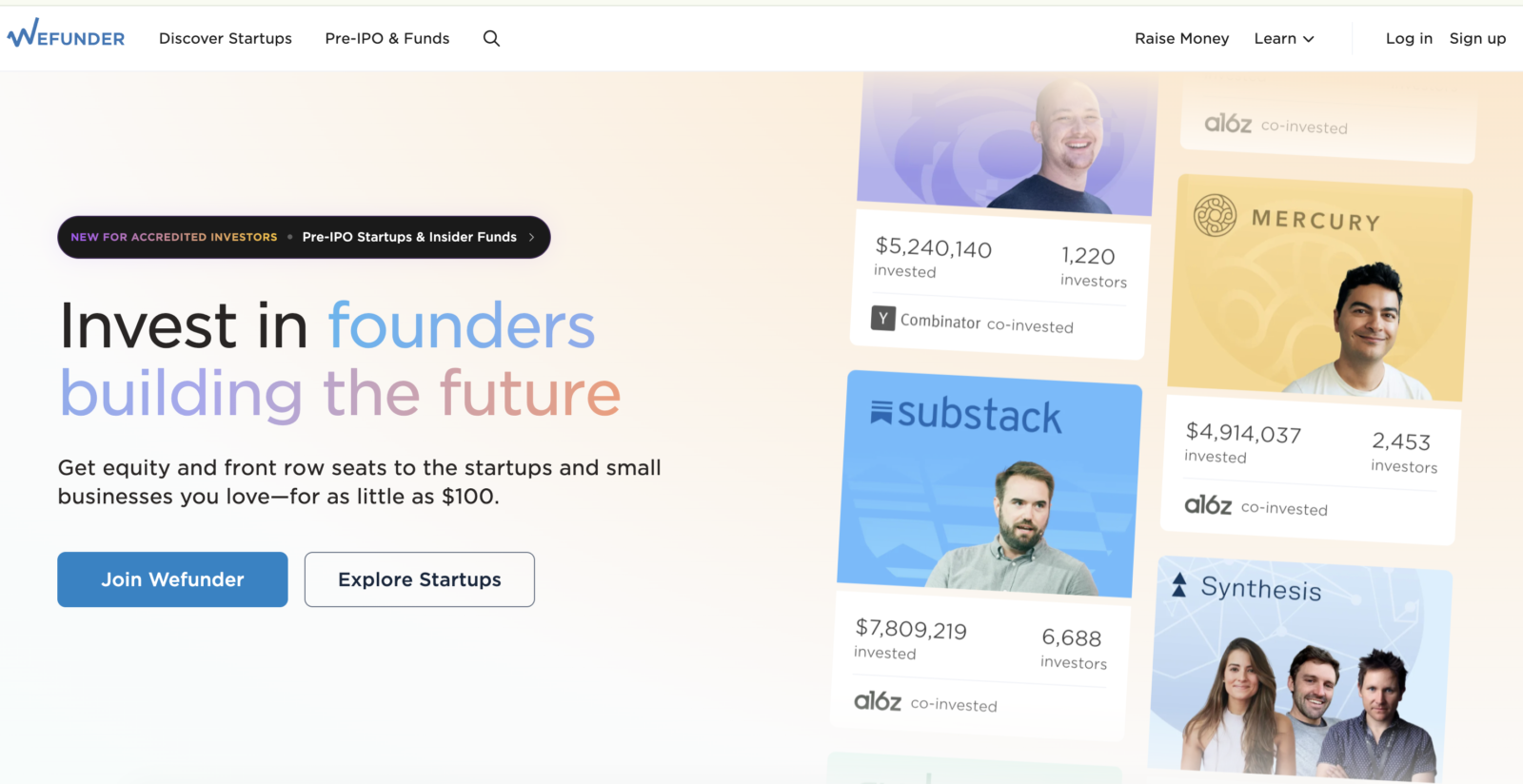

What is Wefunder.com?

Wefunder.com is an online equity-crowdfunding platform that allows startups and early-stage companies to raise money from everyday investors. Instead of relying solely on venture capital, founders can seek funding from the public, offering equity, convertible notes, or other financial instruments in return.

Wefunder.com markets itself as a platform that democratizes startup investing, promising ordinary people the chance to back the next big company. On the surface, it appears to be a legitimate, innovative tool for investors looking to support new businesses.

But beneath the polished marketing lies a series of risks, complaints, and red flags that have led many investors to label Wefunder.com a scam — or at the very least, a platform that behaves like one.

Key Concerns About Wefunder.com

Poor Investor Protection

One of the biggest problems with Wefunder.com is the lack of oversight over the companies raising funds. Multiple users have reported that some startups “go dark” after receiving investments, failing to provide updates or communicate with investors. Once the funds are transferred, Wefunder.com itself does not guarantee accountability or transparency, leaving investors in the dark if a startup fails or disappears.

This lack of protection makes it extremely risky for investors, and many have lost money without any recourse.

Opaque Fees and Fund Transfers

Wefunder.com has also faced criticism for unclear fees and confusing fund transfer procedures. Some investors report that their money was withdrawn immediately, yet the intended companies never received the funds. In some cases, the platform charged transaction fees without explanation, making it difficult for users to understand exactly what happened to their investments.

Delays, barriers to withdrawals, and unhelpful customer support exacerbate these problems, increasing the risk of losing funds.

Lack of Communication

Even when companies raise funds successfully, many investors report being left without updates. Communication often ceases entirely after the fundraising campaign ends. This “ghosting” leaves investors uncertain about whether their equity is valid, whether the company is operational, or whether any returns will ever materialize.

For many investors, this lack of accountability feels indistinguishable from a scam.

High Risk of Loss

Investing in early-stage startups is inherently risky. Most startups fail, and even successful ones may take years to provide any financial return. Wefunder.com does not mitigate this risk, meaning investors can lose their entire investment. Many users report that after years of waiting, they see no updates or returns, which has led to widespread frustration and skepticism.

Technical Issues and Poor Support

Some investors also experience technical difficulties, such as problems linking bank accounts, withdrawing funds, or accessing account information. Customer support is frequently described as slow, unhelpful, or unresponsive, compounding the stress and uncertainty of using the platform.

International investors face additional hurdles due to restricted banking options, adding another layer of risk.

Real Investor Experiences

Many users have shared firsthand experiences of losing money on Wefunder.com:

-

Funds invested never reached the startup, and efforts to recover them were unsuccessful.

-

Companies disappeared or stopped communicating entirely after raising capital.

-

Technical issues prevented investors from tracking or managing their investments.

-

High transaction fees and opaque processes left users confused and frustrated.

While Wefunder.com may host some legitimate and successful campaigns, these negative experiences are common and highlight the potential danger of using the platform.

How Online Fraud Often Works

Internet scams use clever tactics to win trust before stealing cash. Below are a few tricks that sites like Wefunder.com may use.

“Pig-Butchering” Romance & Investment Scams

In a “pig-butchering” scheme, fraudsters spend weeks building a fake online relationship through social media, dating apps, or random texts. Once the victim feels safe, the scammer introduces a “great” crypto or forex deal and pushes them onto a phony trading site.

Imitation Of Real Trading Platforms

Scammers design web or mobile apps that look like real trading dashboards. Charts move and balances grow, yet every figure is controlled by the crooks. They may even allow a small withdrawal first to appear trustworthy, then press victims to invest more.

Warning signs of such fake brokers include:

- Unexpected contact: Cold calls or random messages about investments.

- No licence number: Either unregistered or using a fake one.

- Guarantees of huge profit: Promises of daily or monthly returns.

- Blocked withdrawals: Extra “fees” or “taxes” demanded before any payout—yet funds never arrive.

- Polished interface: A slick site that hides the absence of regulation.

They also post fake reviews and celebrity endorsements to look credible.

Steps to Take After Being Scammed

If you believe Wefunder.com deceived you, follow these steps right away:

-

- Stop All Communication: Once you realize you’ve been scammed, stop any communication with the fraudulent platform. Scammers may try to manipulate you into making further deposits by claiming there’s a way to recover your initial investment.

- Document Everything: Collect all relevant evidence of your transactions and communications with the platform. This includes screenshots of conversations, transaction receipts, and any emails or documents provided by the scam broker.

- Report the Scam: It is important to report the scam to the authorities and relevant online platforms. Websites like LOSTFUNDSRECOVERY.COM provide a detailed process for reporting cryptocurrency scams and ensuring they are documented for investigation.

- Seek Professional Help: Crypto scams are complex and often require professional assistance to recover lost funds. This is where services like LOSTFUNDSRECOVERY.COM come into play.

How LostFundsRecovery.com Can Help You Recover from the Scam

If you have been a victim of the Wefunder.com scam, all hope is not lost. Recovery firms like LostFundsRecovery.com specialize in helping scam victims retrieve their lost funds. Here’s how LostFundsRecovery.com can assist:

1. Investigating the Fraud

LostFundsRecovery.com conducts thorough investigations into scam brokers. By analyzing transactions, tracking digital footprints, and gathering evidence, they build a strong case against fraudulent platforms like Wefunder.com.

2. Chargeback Assistance

Many victims who deposit funds via credit or debit cards may be eligible for chargebacks. LostFundsRecovery.com guides clients through the chargeback process by providing necessary documentation and liaising with banks and financial institutions.

3. Cryptocurrency Transaction Tracing

If you deposited funds in cryptocurrency, recovery can be more challenging. However, LostFundsRecovery.com uses blockchain analysis tools to track and trace stolen digital assets. Identifying wallet addresses and transaction histories can provide crucial leads in fund recovery.

4. Legal Support

LostFundsRecovery.com collaborates with legal experts to take action against scam brokers. Depending on the jurisdiction, they can help file complaints with financial regulators, law enforcement, and cybersecurity agencies.

5. Prevention and Education

In addition to fund recovery, LostFundsRecovery.com educates victims on avoiding future scams. By raising awareness about fraudulent schemes, they help investors make informed decisions and safeguard their assets.

Conclusion

Wefunder.com exhibits nearly every characteristic of a scam: lack of regulation, hidden ownership, manipulated trading conditions, blocked withdrawals, and aggressive marketing tactics. User reports overwhelmingly indicate that deposits are at high risk, and there is little to no recourse for recovering funds. If you have lost money to this scam, seeking professional recovery assistance is crucial. Report to a recovery companyWho offers specialized services to help victims reclaim their funds and take legal action against fraudulent brokers.

To avoid falling victim to such scams in the future, always conduct thorough research before investing with any online trading platform. Stick to regulated brokers, verify credentials, and remain cautious of high-return promises that seem too good to be true.

Stay Informed. Stay Safe.

For more scam reviews and fraud prevention tips, visit Trustjabber.

Leave a comment