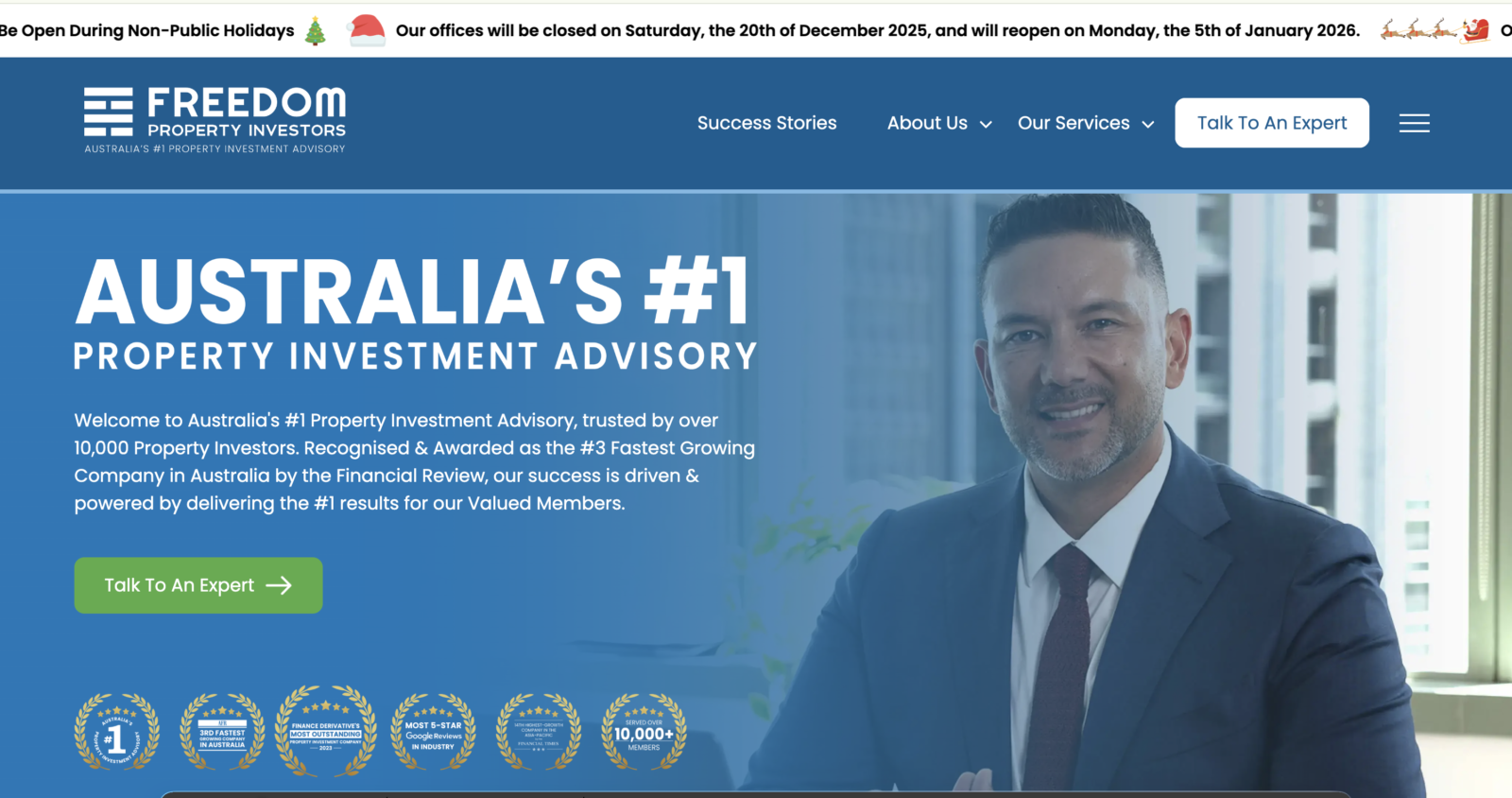

Investing in property is one of the most common ways Australians aim to build wealth. With promises of passive income, capital growth, and long-term financial security, it’s no surprise that many turn to property advisory platforms for guidance. One such platform that has gained attention is FreedomPropertyInvestors.com. While the company presents itself as a trusted property investment advisory, a closer examination raises serious concerns for prospective investors.

This article provides a detailed overview of FreedomPropertyInvestors.com, highlighting what the company claims to offer, the experiences of its clients, the patterns that raise red flags, and why caution is essential before engaging with them.

What is FreedomPropertyInvestors.com and What They Claim to Offer

FreedomPropertyInvestors.com positions itself as a property investment advisory and consultancy designed to help investors, including first-time investors and those using Self-Managed Super Funds (SMSFs), acquire investment properties in Australia. Their services typically include:

-

Membership for consultation or property strategy services, often requiring an upfront fee.

-

Promises to identify “high-growth” properties, frequently off-the-plan.

-

Hand-held support through the buying process, including financing assistance, conveyancing, tax depreciation schedules, liaising with developers, and property management.

-

Marketing that emphasizes wealth creation, passive income, negative gearing, and leveraging SMSFs to build property portfolios.

While at first glance this model may seem legitimate, multiple independent evaluations and client reviews suggest systemic issues in how FreedomPropertyInvestors.com operates.

What Users Are Saying — Common Complaints

Many investors have shared negative experiences with FreedomPropertyInvestors.com, and a consistent set of patterns emerges. Some of the recurring themes include:

Aggressive Sales Tactics

Many clients report high-pressure marketing and sales strategies. Persistent calls, repeated follow-ups, and pressure to make quick decisions are common complaints. Users describe the experience as being continuously bombarded by sales representatives even after expressing disinterest.

Financial Losses

Several investors claim significant financial losses after engaging with FreedomPropertyInvestors.com. Reports include investments in off-the-plan properties that did not yield the promised rental income or failed to appreciate as expected. In some cases, clients state that the properties were overvalued, leading to negative equity immediately after purchase.

Misleading Promises

Off-the-plan properties are frequently marketed with guaranteed delivery dates and projected growth. However, many clients have reported delays of several years in property completion. Others experienced discrepancies between the promised valuation and the actual bank valuation at settlement, leaving them financially disadvantaged.

Poor Post-Sale Support

Clients often report that after paying fees or signing contracts, communication from FreedomPropertyInvestors.com dwindles or disappears entirely. Requests for guidance, updates, or refunds are frequently met with silence, leaving investors feeling abandoned.

Conflict of Interest

Some investors allege that FreedomPropertyInvestors.com prioritizes properties that provide higher commissions rather than those that suit the client’s investment goals. This commission-driven approach often results in clients being encouraged to buy properties that may not perform well in the long term.

Patterns That Raise Concerns

Examining the recurring issues highlighted by clients, several patterns emerge that should concern potential investors:

-

Lack of Transparency – Investors often struggle to verify the company’s credentials, ownership, and regulatory compliance.

-

Upfront Fees and Commission Incentives – High initial fees and reliance on commissions create strong incentives for sales rather than client-focused advice.

-

Promises vs. Reality – Delays in property delivery, overvalued properties, and poor rental yields are common.

-

Poor Communication – Once fees are paid, many clients report a significant drop in support and assistance.

-

Targeting Vulnerable Investors – Many of the clients are first-time property buyers or SMSF investors who may lack the experience to independently assess investment risk.

These patterns collectively paint a picture of a company whose priorities may be more aligned with generating revenue than delivering consistent, successful investment outcomes for clients.

Real-Life Investor Experiences

To better understand the risks associated with FreedomPropertyInvestors.com, here are some of the experiences shared by clients:

-

Delays in Property Delivery: Investors report waiting years longer than initially promised to take possession of properties purchased off-the-plan.

-

Lower-than-Expected Valuations: Some investors discovered that the market value of the property upon settlement was significantly lower than the purchase price.

-

Ongoing Costs vs. Returns: Properties often come with high ongoing costs such as mortgage interest, maintenance, and strata fees, combined with lower-than-expected rental returns.

-

Lack of Post-Sale Support: Investors frequently report receiving little to no guidance or assistance after payment, leaving them to manage issues independently.

-

Emotional and Financial Stress: Many clients describe the experience as frustrating and stressful, compounded by financial losses and unmet expectations.

Why FreedomPropertyInvestors.com Serves as a Cautionary Tale

The experiences of investors and the patterns observed with FreedomPropertyInvestors.com underscore a broader lesson for anyone considering property investment advisory services:

-

Incentive Misalignment: When revenue comes from commissions and upfront fees rather than performance or client success, the advice may not be in the investor’s best interest.

-

Marketing vs. Reality: Glossy presentations and promises of passive income or guaranteed growth should be carefully scrutinized.

-

Due Diligence is Essential: Independent research, valuations, and verification of credentials are critical before making financial commitments.

How Online Fraud Often Works

Internet scams use clever tactics to win trust before stealing cash. Below are a few tricks that sites like FreedomPropertyInvestors.com may use.

“Pig-Butchering” Romance & Investment Scams

In a “pig-butchering” scheme, fraudsters spend weeks building a fake online relationship through social media, dating apps, or random texts. Once the victim feels safe, the scammer introduces a “great” crypto or forex deal and pushes them onto a phony trading site.

Imitation Of Real Trading Platforms

Scammers design web or mobile apps that look like real trading dashboards. Charts move and balances grow, yet every figure is controlled by the crooks. They may even allow a small withdrawal first to appear trustworthy, then press victims to invest more.

Warning signs of such fake brokers include:

- Unexpected contact: Cold calls or random messages about investments.

- No licence number: Either unregistered or using a fake one.

- Guarantees of huge profit: Promises of daily or monthly returns.

- Blocked withdrawals: Extra “fees” or “taxes” demanded before any payout—yet funds never arrive.

- Polished interface: A slick site that hides the absence of regulation.

They also post fake reviews and celebrity endorsements to look credible.

Steps to Take After Being Scammed

If you believe FreedomPropertyInvestors.com deceived you, follow these steps right away:

-

- Stop All Communication: Once you realize you’ve been scammed, stop any communication with the fraudulent platform. Scammers may try to manipulate you into making further deposits by claiming there’s a way to recover your initial investment.

- Document Everything: Collect all relevant evidence of your transactions and communications with the platform. This includes screenshots of conversations, transaction receipts, and any emails or documents provided by the scam broker.

- Report the Scam: It is important to report the scam to the authorities and relevant online platforms. Websites like LOSTFUNDSRECOVERY.COM provide a detailed process for reporting cryptocurrency scams and ensuring they are documented for investigation.

- Seek Professional Help: Crypto scams are complex and often require professional assistance to recover lost funds. This is where services like LOSTFUNDSRECOVERY.COM come into play.

How LostFundsRecovery.com Can Help You Recover from the Scam

If you have been a victim of the FreedomPropertyInvestors.com scam, all hope is not lost. Recovery firms like LostFundsRecovery.com specialize in helping scam victims retrieve their lost funds. Here’s how LostFundsRecovery.com can assist:

1. Investigating the Fraud

LostFundsRecovery.com conducts thorough investigations into scam brokers. By analyzing transactions, tracking digital footprints, and gathering evidence, they build a strong case against fraudulent platforms like FreedomPropertyInvestors.com.

2. Chargeback Assistance

Many victims who deposit funds via credit or debit cards may be eligible for chargebacks. LostFundsRecovery.com guides clients through the chargeback process by providing necessary documentation and liaising with banks and financial institutions.

3. Cryptocurrency Transaction Tracing

If you deposited funds in cryptocurrency, recovery can be more challenging. However, LostFundsRecovery.com uses blockchain analysis tools to track and trace stolen digital assets. Identifying wallet addresses and transaction histories can provide crucial leads in fund recovery.

4. Legal Support

LostFundsRecovery.com collaborates with legal experts to take action against scam brokers. Depending on the jurisdiction, they can help file complaints with financial regulators, law enforcement, and cybersecurity agencies.

5. Prevention and Education

In addition to fund recovery, LostFundsRecovery.com educates victims on avoiding future scams. By raising awareness about fraudulent schemes, they help investors make informed decisions and safeguard their assets.

Conclusion

FreedomPropertyInvestors.com exhibits nearly every characteristic of a scam: lack of regulation, hidden ownership, manipulated trading conditions, blocked withdrawals, and aggressive marketing tactics. User reports overwhelmingly indicate that deposits are at high risk, and there is little to no recourse for recovering funds. If you have lost money to this scam, seeking professional recovery assistance is crucial. Report to a recovery companyWho offers specialized services to help victims reclaim their funds and take legal action against fraudulent brokers.

To avoid falling victim to such scams in the future, always conduct thorough research before investing with any online trading platform. Stick to regulated brokers, verify credentials, and remain cautious of high-return promises that seem too good to be true.

Stay Informed. Stay Safe.

For more scam reviews and fraud prevention tips, visit Trustjabber.

Leave a comment