Introduction — Why We’re Investigating PCRInsights.com

The online investment landscape is filled with platforms claiming to offer advanced financial tools, but not all are trustworthy. PCRInsights.com presents itself as a sophisticated provider of financial data aggregation and portfolio management solutions aimed at institutional clients, family offices, and wealth-tech firms.

At first glance, the platform seems professional and highly credible. However, several warning signs suggest that PCRInsights.com may not be as reliable as it claims. This review highlights the key concerns, potential risks, and what investors should know before considering this platform.

What PCRInsights.com Claims

PCRInsights.com markets itself as a business-to-business (B2B) provider of:

-

Investment data consolidation across custodial and alternative accounts

-

Integrated portfolio reporting tools

-

Statement operations, reporting suites, and data publishing

The platform claims to serve hundreds of financial firms globally and manage hundreds of billions of dollars across thousands of accounts. Clients allegedly include private banks, registered investment advisors, family offices, and institutional allocators.

While these claims sound impressive, there is limited publicly verifiable evidence, raising doubts about whether PCRInsights.com actually operates at the scale it claims.

Shocking Red Flags to Watch

1. Extremely Limited Public Footprint

For a company claiming to manage billions in assets, PCRInsights.com has a surprisingly small online presence. There are few independent client testimonials, little press coverage, and almost no verifiable references. Legitimate firms at this scale typically maintain a robust public footprint.

2. Sparse and Unverified Reviews

Reviews for PCRInsights.com are scarce and largely unverified. A genuine financial services provider of its purported size would usually have extensive client feedback or case studies. The lack of verified reviews raises serious concerns about transparency.

3. Exaggerated and Unverified Claims

The platform asserts that it manages hundreds of billions in assets and integrates with thousands of custodians. Without supporting evidence, these claims appear highly ambitious and may be used as marketing tactics to gain trust.

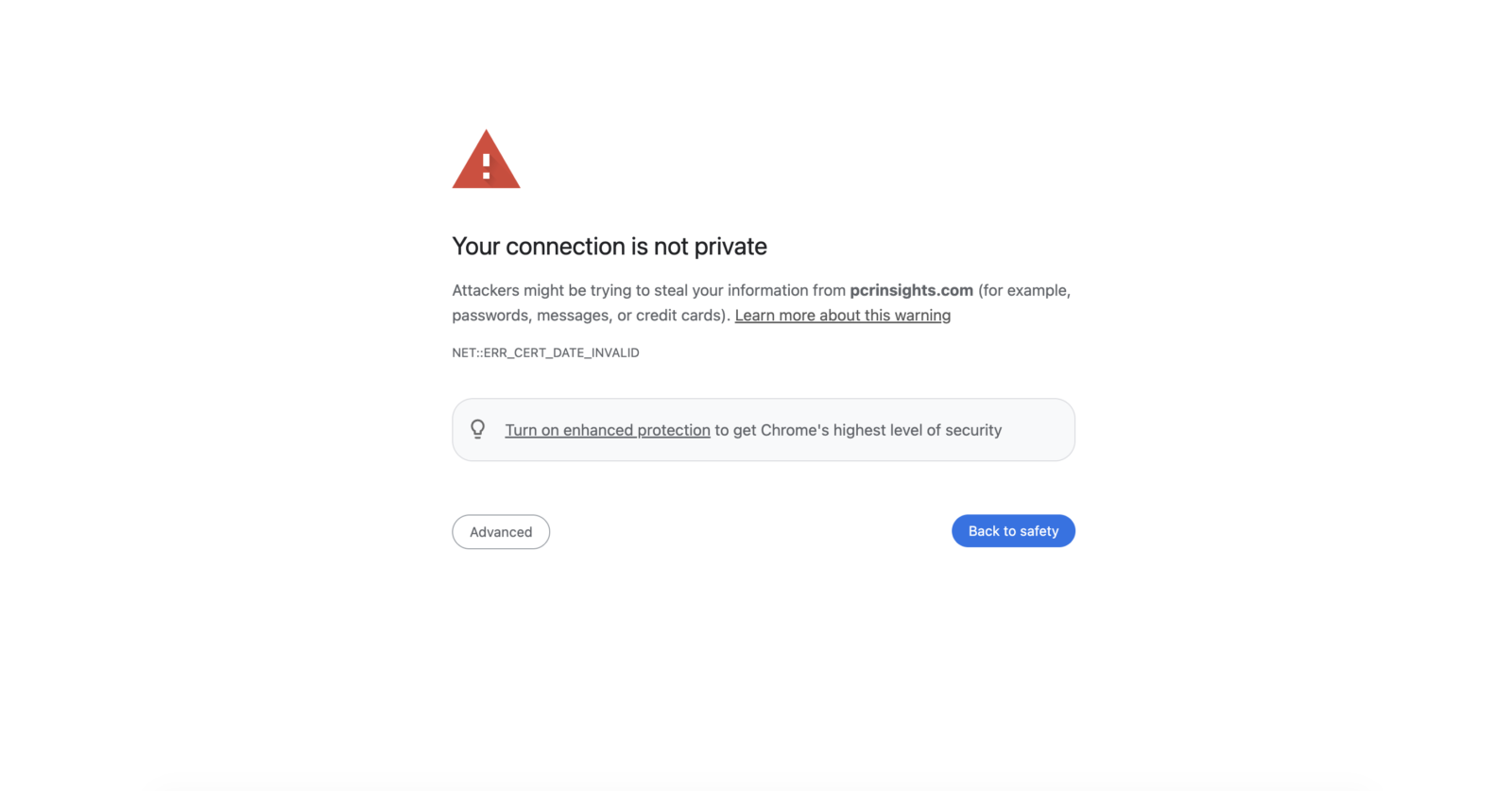

4. Lack of Regulatory Oversight

PCRInsights.com does not display any regulatory licenses or compliance certifications. Legitimate platforms handling sensitive financial data and client funds usually operate under clear regulatory frameworks. This absence of oversight introduces risk for potential users.

5. Misalignment Between Claims and Evidence

While the platform positions itself as a backend provider for wealth management firms, there is minimal observable evidence of client adoption or operational scale. The mismatch between claims and verifiable outcomes suggests potential misrepresentation.

Why PCRInsights.com May Appear Credible

Despite the red flags, the platform can seem legitimate to some users due to:

-

Sophisticated Industry Jargon: Terms like “custodial aggregation” and “portfolio reporting” convey professionalism.

-

Impressive-Sounding Numbers: Hundreds of billions in assets and hundreds of clients suggest scale.

-

Polished Website Design: A sleek and professional interface can create a false sense of trust.

These features may lure investors unfamiliar with the nuances of financial data aggregation.

How Scammers Often Operate Online

Fraudsters use tactics designed to gain trust before defrauding users. Common approaches include:

Imitation of Legitimate Platforms

-

Fake dashboards with moving charts and balances

-

Initial small withdrawals to build confidence

-

Pressure to invest more after initial trust is established

Common Warning Signs

-

Unexpected contact through calls, emails, or social media

-

No valid license or regulatory oversight

-

Promises of unusually high returns

-

Blocked withdrawals with extra “fees” or taxes

-

Fake reviews and celebrity endorsements

Steps to Take If You’ve Been Scammed

If you suspect PCRInsights.com is fraudulent, take these steps:

-

Stop All Communication — Avoid further contact with the platform.

-

Document Everything — Save screenshots, emails, and transaction records.

-

Report the Scam — Notify authorities and reporting platforms. Services like LostFundsRecovery.com guide victims through proper reporting procedures.

-

Seek Professional Help — Complex scams often require expert assistance for fund recovery.

Disclaimer: LostFundsRecovery.com mentions are informational only. TrustJabber does not guarantee recovery outcomes.

How LostFundsRecovery.com Can Assist

Professional recovery services help victims of online investment scams through:

-

Fraud Investigation — Tracking digital footprints, analyzing transactions, and gathering evidence.

-

Chargeback Assistance — Helping clients recover funds deposited via credit or debit cards.

-

Cryptocurrency Transaction Tracing — Using blockchain analysis to track stolen digital assets.

-

Legal Support — Filing complaints with regulators, law enforcement, and cybersecurity authorities.

-

Education and Prevention — Guiding users on avoiding future scams and making informed investment choices.

Conclusion

PCRInsights.com exhibits multiple warning signs of a potentially fraudulent platform:

-

Hidden ownership and lack of regulatory oversight

-

Sparse, unverified reviews and limited public footprint

-

Exaggerated claims about assets and client adoption

Investors should exercise extreme caution. If funds have been lost, documenting interactions, reporting the incident, and seeking professional recovery assistance is essential.

Always research thoroughly, stick to regulated providers, and be skeptical of platforms promising high returns without verifiable evidence.

Stay Informed. Stay Safe.

For more scam reviews and fraud prevention advice, visit TrustJabber.

Internal Resources for Guidance:

For additional guidance, consider these linked resources on your platform:

-

Protect yourself with our [Online Scam Safety Guide.]

-

Learn to assess platforms using [How to Verify Trading Platforms]

-

Steps to take with suspicious sites in [What to Do After Being Scammed]

Leave a comment